Subject

- #Technological Advancements

- #Regulation

- #Bitcoin Dominance

- #Altcoins

- #Cryptocurrency Market

Created: 2024-12-27

Created: 2024-12-27 10:00

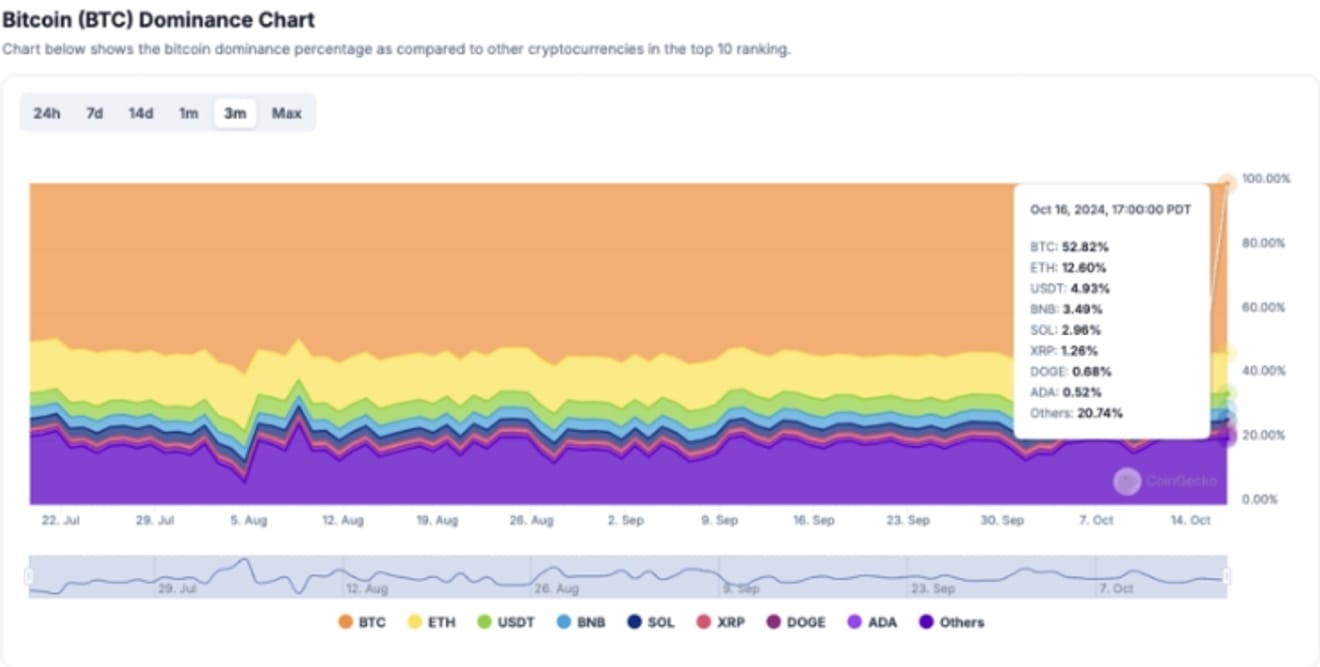

What is Bitcoin Dominance? Bitcoin dominance is an indicator that represents Bitcoin's market share. It refers to the percentage of Bitcoin's market capitalization in the overall cryptocurrency market. A higher number indicates Bitcoin's greater dominance in the market, while a lower number suggests that other altcoins are relatively rising.

Bitcoin's dominance is a crucial indicator reflecting Bitcoin's position and credibility in the cryptocurrency market. For example, if Bitcoin's dominance exceeds 70%, it indicates that many investors are focused on Bitcoin. Conversely, if it falls below 40%, it signals increased interest in altcoins.

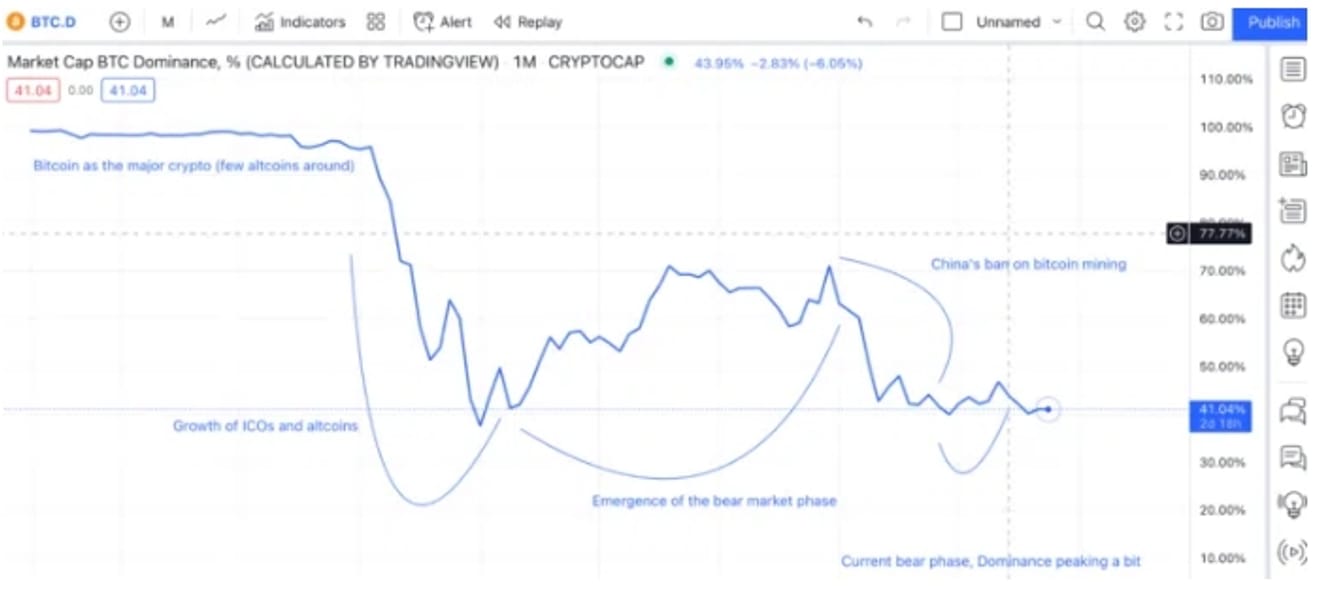

Looking at the historical background of Bitcoin dominance, Bitcoin initially started as a single cryptocurrency after its launch in 2009. However, as time passed, numerous altcoins emerged, and Bitcoin's dominance underwent changes. In 2017, Bitcoin's dominance reached 85%, but this figure gradually decreased due to the emergence of various altcoins. Currently, Bitcoin's dominance fluctuates between approximately 40% and 60%.

Various analyses and forecasts regarding Bitcoin dominance predictions for 2025 are emerging. Blockmedia recently reported that if Bitcoin maintains a price above $95,000, there is a possibility that its dominance will rise again. This implies that Bitcoin's price increase could lead to a relative decrease in the value of other cryptocurrencies. Currently, Bitcoin's dominance is influenced by various factors, with the development of altcoins and market changes acting as significant variables.

Furthermore, a decline in Bitcoin dominance could signal the start of altcoin season. TokenPost suggests that specific altcoins, such as Ripple (XRP), are likely to rise in 2025, emphasizing that this is related to a decrease in Bitcoin dominance. In particular, it predicts that XRP is highly likely to rise to $2.57 by the end of 2024.

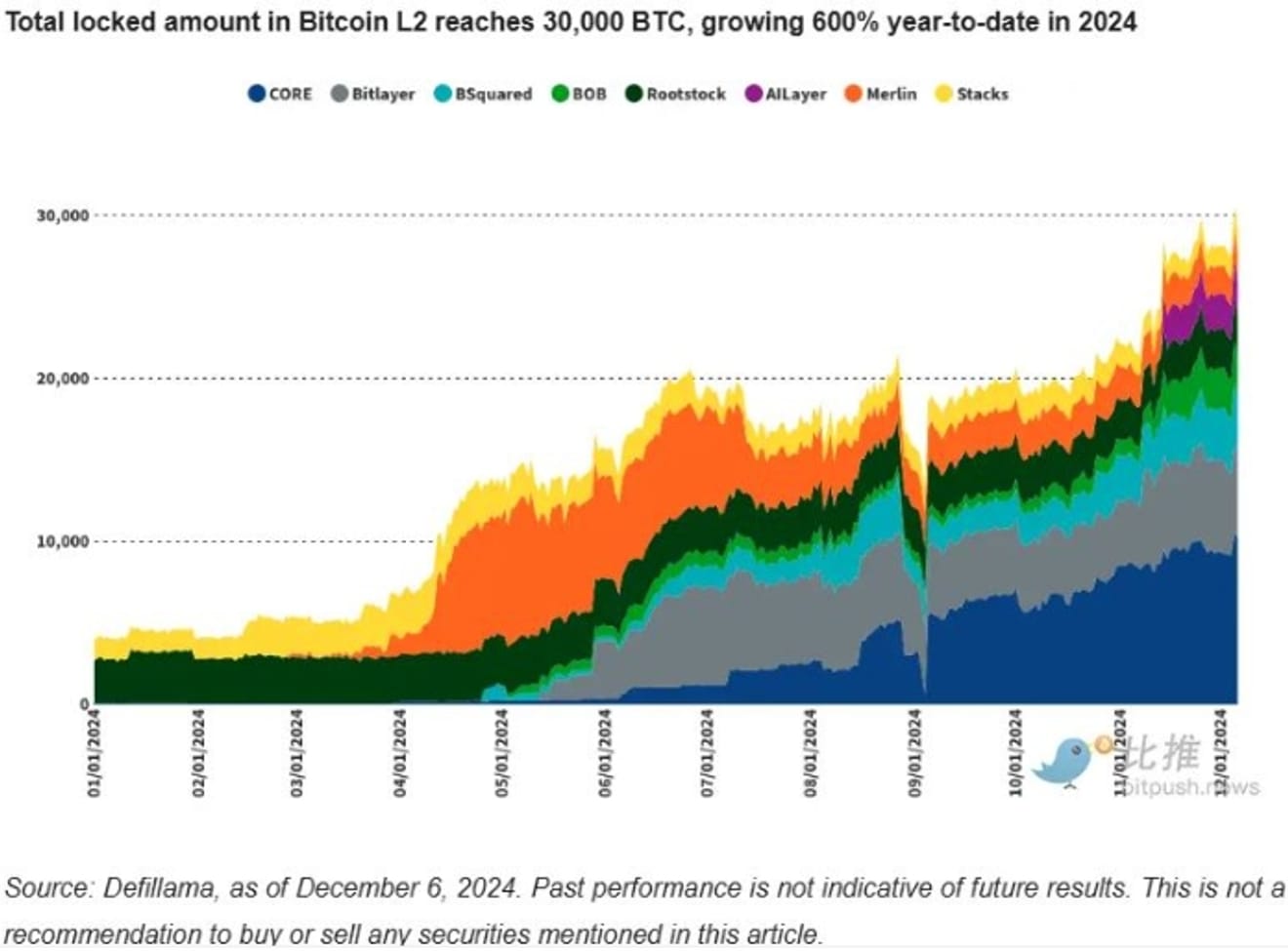

While Bitcoin's competitiveness remains strong, the future trends of the altcoin market cannot be ignored. The recent increased interest in L2 solutions is expected to affect Bitcoin's dominance. In 2024, the total value locked in Bitcoin Layer 2 solutions reached 30,000 BTC, representing a 600% growth rate. These L2 solutions are expected to play a significant role in improving Bitcoin's performance and scalability.

Factors influencing Bitcoin dominance in 2025 include the global economic situation, regulatory environment, and technological advancements. In particular, political instability or changes in the financial market can significantly impact cryptocurrencies. For example, if a particular country strengthens regulations on Bitcoin and cryptocurrencies, investors are more likely to choose Bitcoin as a safer asset.

Finally, while Bitcoin's future outlook is bright, uncertainty also exists. If dominance recovers to over 60%, Bitcoin could once again become the center of the market. However, changes in dominance in 2025 could also accompany a resurgence of altcoins, leading to a more diversified market. Therefore, investors should proactively adapt to these changes.

Considering these various aspects, Bitcoin dominance is not merely an indicator but a crucial measure that reflects the overall trends of the cryptocurrency market. We should continue to carefully observe Bitcoin's dominance.

Technological Advancements: As Bitcoin's blockchain technology continues to develop, transaction speed and security will improve. This technological progress can enhance Bitcoin's reliability and strengthen its dominance. In particular, innovative technologies such as Layer 2 solutions will improve Bitcoin's scalability, providing opportunities for more users to participate.

Regulatory Changes: The regulatory policies of various governments will significantly impact Bitcoin's market dominance. A positive regulatory environment can increase Bitcoin dominance, while negative regulation can decrease it. For example, if the US and European countries establish clear regulations for cryptocurrencies, market credibility will increase, potentially leading to an increase in Bitcoin dominance.

Competing Cryptocurrencies: The growth of various altcoins such as Ethereum and Solana will challenge Bitcoin's dominance. In particular, the development of DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) will increase interest in altcoins. This trend could potentially decrease Bitcoin dominance, but Bitcoin's unique characteristics and security will allow it to maintain a significant position.

Investor Sentiment: Investor sentiment significantly impacts Bitcoin dominance. A positive market outlook increases demand for Bitcoin, leading to higher dominance. Conversely, if market uncertainty increases, investors may turn to altcoins. Therefore, Bitcoin's dominance can fluctuate significantly depending on investor sentiment.

Bitcoin dominance will remain a crucial indicator in the cryptocurrency market in 2025. Market changes, technological advancements, and the regulatory environment must be carefully considered. Investors should make investment decisions considering these factors. Bitcoin remains a leading cryptocurrency, and its future outlook is bright. Market participants can use Bitcoin's dominance to predict market changes and make strategic investment decisions.

Comments0