Subject

- #Interest Savings

- #Interest Rate Reduction

- #Application Method

- #Right to Demand a Lower Interest Rate

- #Credit Status

Created: 2025-07-03

Created: 2025-07-03 23:12

What is the right to request a rate reduction, and how can I apply and what are the qualifications?

We will provide tips and precautions for applying for the right to request a rate reduction that working people, self-employed individuals, and those new to the workforce should know.

The right to request a rate reduction is a legal right that allows you to request a lower interest rate from a financial institution after taking out a loan when your credit status has improved.

This system has been legislated since June 2019 and is available to everyone.

It can be actively utilized, especially if your credit score has increased or your income has increased.

You can apply for the right to request a rate reduction if you meet one or more of the following conditions.

If your credit rating or score has improved

If your annual income has increased or your job has changed

If job stability has been strengthened, such as promotions or conversion to permanent employment

If your financial situation has improved, such as a decrease in the debt ratio or completion of repayment of other loans

In other words, you can apply if it is determined that your ‘credit status’ or ‘financial capacity’ has improved compared to when you took out the loan.

Most banks, savings banks, insurance companies, and credit card companies operate the right to request a rate reduction.

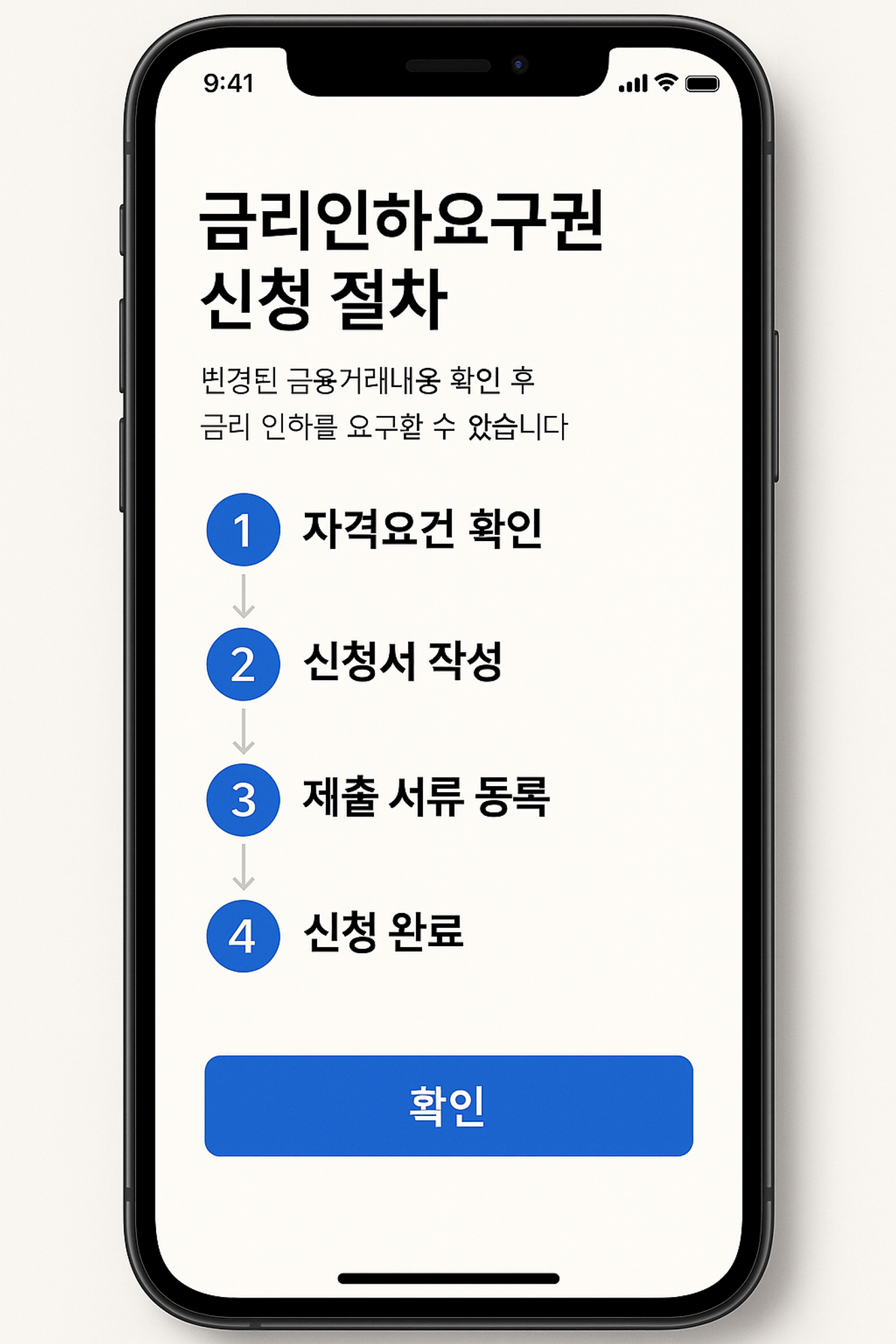

You can apply through the website or app of each financial company.

Certificate of employment or business registration certificate

Income verification documents (pay stubs, income amount certificate, etc.)

Proof of credit rating improvement (credit report, etc.)

Mobile app: Use the application menu in the bank app or financial company app

Internet banking: My Page > Loan Management > Apply for Rate Reduction

Visit the branch: Apply directly at the consultation counter

Procedures may vary slightly depending on the financial institution, so it is recommended to check with the customer service center in advance.

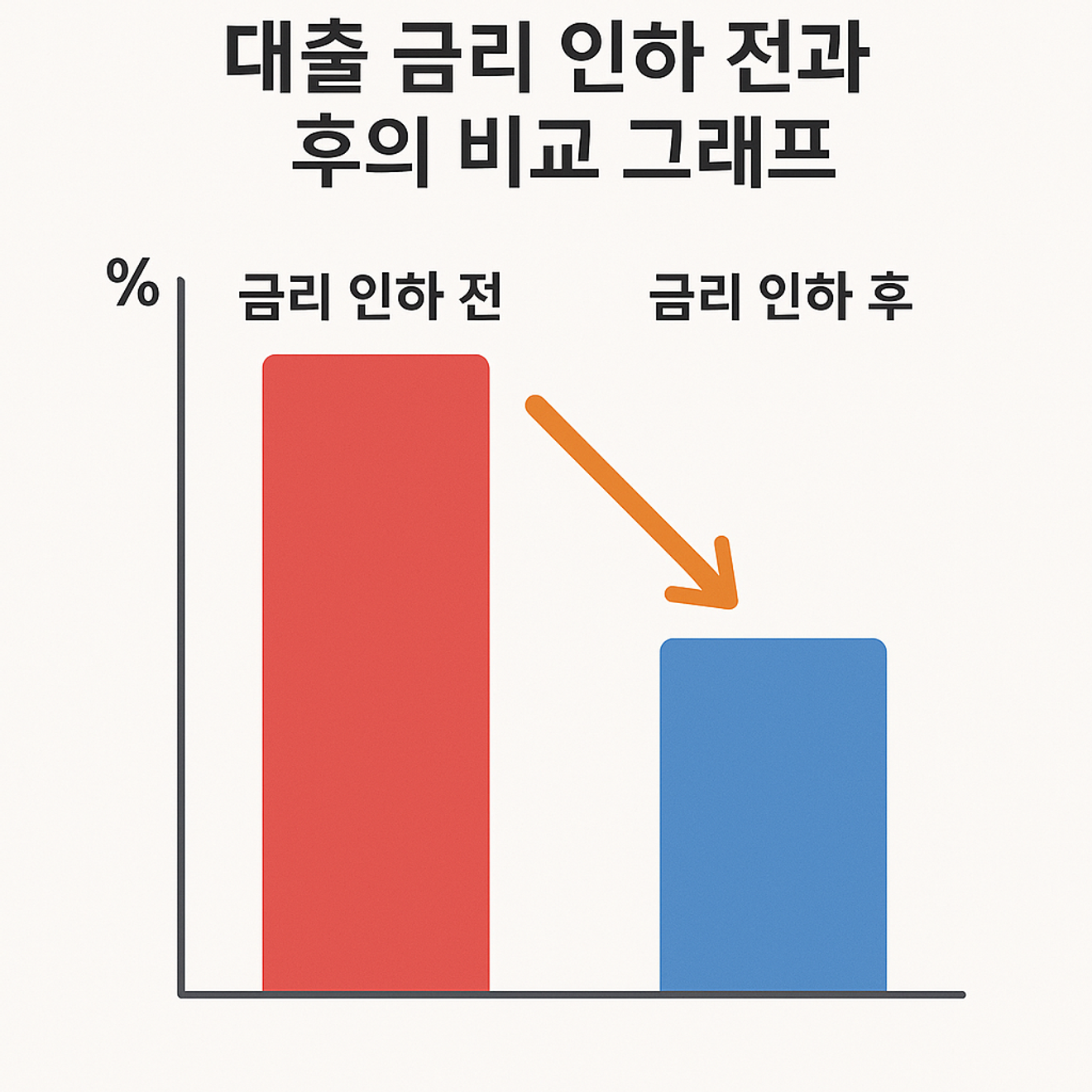

If approved, the interest rate can be reduced by an average of 0.2% to 1.0%p.

This is a figure that can significantly reduce the burden of interest, especially for large or long-term loans.

Example) For a 100 million won loan, reducing the rate by only 0.5%p can save more than 500,000 won in annual interest.

The right to request a rate reduction may be rejected in the following cases.

If a certain period of time has not passed since the loan was executed (e.g., within 6 months)

If there is not much change in the credit status or if there is insufficient evidence

If the loan is already at the lowest interest rate level

If there is negative credit information such as a history of arrears

The right to request a rate reduction is a ‘right,’ but the approval is determined according to the financial institution's review.

It is important to present clear data and the basis for changes.

For working people, promotions, job changes, salary increases, and conversion to permanent employment can be major factors in reducing interest rates.

For self-employed individuals, this includes increased sales, improved credit scores, and debt repayment.

Especially these days, in an era of high interest rates, a difference of only 0.5%p in interest rates can save hundreds of thousands of won.

It is recommended to check your situation and apply regularly.

It is usually possible to apply from 6 months to 1 year after the loan is executed.

You can apply about 1 to 2 times a year.

Therefore, it is most efficient to apply after checking the improvement of your credit score,

or in line with the time when there are changes in income.

The right to request a rate reduction may be an opportunity to reduce interest rates that you unknowingly miss.

In an era of fixed interest rates and an era sensitive to loan interest, you need to take care of your financial information yourself,

and it is necessary to actively exercise your rights.

Check your credit status regularly, and if there are changes in your employment or income

Please consider applying for the right to request a rate reduction.

Comments0